Gold has always been a safeguard of American wealth in difficult times. In the changing economic landscape of recent years, American investors are revisiting the idea of owning gold bars as a safe-haven asset. In the midst of the uncertainty of tariffs and global trading, experts suggest investing in physical gold assets as a hedge against inflation.

The Unique Appeal of Gold Bars

Unlike many other investment assets, gold bar investment means holding a physical asset with real value. Gold has survived much turmoil over the years, be it currency crises or market collapse. As many financial advisors have noticed, gold typically increases when other assets have fallen in value.

Key advantages of owning gold bars include:

- Intrinsic value: There is no counterparty risk of having gold bars in the same sense as bonds and bank deposits.

- Long-term store of value: Historically, gold has preserved its purchasing power better than any currency. According to the World Gold Council, in 2025, gold had already gained ~26% in U.S. dollar terms through the first half of the year.

- Diversifier and hedge: When traditional assets struggle in the market, gold shines as a non-correlated asset.

- Liquidity: Most gold bars are liquid assets and can be sold easily under the right conditions.

Economic context: Why owning gold bars now is especially compelling

In 2024 and 2025, many market trends came to the notice of investors that make a strong case for gold bars.

- Gold price in the U.S. reached new all-time highs near US $3,500+ per troy ounce in some studies.

- According to Trading Economics, later in 2025, gold was reported at over US $4,355 per troy ounce, up 60%+ compared to a year earlier.

In short, investors seeking to protect wealth with gold should act now to safeguard themselves against currency fluctuations and geopolitical tensions.

Savings Mindset vs. Security Mindset

Many people save in cash, CDs, or bonds. While they do serve a purpose, they carry certain risks. Inflation can eat away at purchasing power; financial institutions may carry systematic risks and much more.

In contrast, having physical gold represents a shift in investment strategy from “saving” to “securing.” By investing in precious metals like gold, you are securing a real asset with intrinsic value that will hold for generations. In other words, you are moving from wealth accumulation to wealth preservation.

Key considerations when you invest in gold bars

When you decide to buy gold bars, these are some things you should keep in mind:

- Choose a trusted dealer.

- Verify the bar’s mint, weight, and purity.

- Prepare how you plan to store them.

- Understand liquidity: how easily can you resell when needed?

- Different sizes: having a mix of bar weights.

Five Recommended Gold Bar Products

Here are five high-quality gold bars for sale that have great investment potential. Each gold bar has its unique advantages.

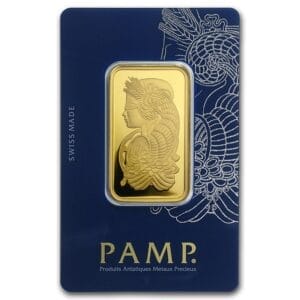

1. 1 Oz Gold Bar – PAMP Suisse Lady Fortuna (In Assay)

This is a very accessible, entry-level bar and ideal for new investors. Each bar is made of 0.9999 fine gold, which makes for investment-grade quality. It is manufactured by PAMP Suisse, which is LBMA-accredited. PAMP Suisse is known for its integrity in the production of bullion.

Advantages

- It features the Roman goddess Fortuna. This has great aesthetic value.

- It comes in sealed assay cards. It incorporates VERISCAN technology to verify authenticity.

- It is widely recognized and easy to trade globally.

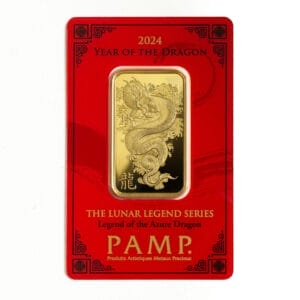

2. 1 Oz Gold Bar – 2024 PAMP Suisse Lunar Legend Azure Dragon

It is crafted from 0.9999 pure gold. It meets the PAMP Suisse world-class standard for precision. The bar has a unique design with the Azure Dragon. It gives a great desirability to collectors. It commemorates the Chinese year of the dragon.

Advantages

- It has great aesthetic and collectible value.

- It is part of the Lunar Legend series. It combines the gold value with a limited-edition appeal that gains appreciation over time.

- Each of the bars includes assay certificates that verify its weight and purity.

3. 1 Oz Gold Bar – The Royal Mint Britannia (In Assay)

It contains 1 troy ounce of 99.99% fine gold. It is produced by the trusted The Royal Mint, which is the official mint of the UK. The mint is well-known for its craftsmanship.

Advantages

- It has exceptional quality.

- It retains value over time.

- It comes sealed in a protective assay card. It prevents tampering and certifies the purity and authenticity.

- It has an iconic design of Britannia, which has an appeal to collectors and investors alike.

4. 1 Oz Gold Bar – Argor Heraeus (New with Assay)

Each bar is made of 99.99% pure gold (.9999 fine). It ensures the highest quality for all the bars. It comes sealed in a tamper-evident assay card. It is produced by Credit Suisse, which is one of the most respected names in precious metals. These bars are widely recognized and easily tradable.

Advantages

- It is highly liquid in global markets.

- It comes sealed in an assay card. It has a matching unique serial number for added security.

- It is affordable and easy to store for investors.

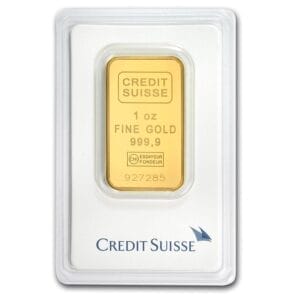

5. 1 Oz Gold Bar – Credit Suisse (In Assay)

Each bar is made of 99.99% pure gold. It ensures the highest quality. It comes sealed in a tamper-evident assay card. It is produced by Credit Suisse, which is one of the most respected names in precious metals. These bars are widely recognized and easily tradable.

Advantages

- The 1 oz size gives an affordable option for early investors.

- It has compact and secure packaging. That makes it ideal for storage and transport.

- It is highly liquid and can be traded all over the world.

Own Real Value With Trusted Gold Dealers

Paper wealth can fade, but the value of gold endures. By owning gold bars, you ground yourself in an asset that has centuries of stability. The next generation deserves more than just a number on a screen. They deserve an asset that lasts.

Conclusion

New York Gold Co. knows true wealth is built on investment choices that offer lasting protection. In times of crises, we offer you an investment choice that will withstand all storms. We simplify buying gold in 2025 with certified products and transparent pricing.

Take your first step towards long-term financial security with New York Gold Co. today.

Frequently Asked Questions about Investing in Gold Bars:

Q1. Why should I consider investing in gold bars?

A1. Owning gold bars helps preserve your wealth against inflation and market crises. It has a long-term store of value that has been trusted for centuries.

Q2. Are gold bars a worthwhile investment in 2025?

A2. Yes. 2025 has already seen quite a lot of global inflation and geopolitical tension. Buying gold now is one of the best ways to protect your wealth.

Q3. What makes gold bars different from gold coins?

A3. Gold bars usually have a lower premium and a higher purity. It makes them ideal for investment.