In the world of precious metals investment, silver stands out as a timeless favorite. However, within the realm of silver, there exists a distinction between silver coins vs silver rounds. While both hold value, understanding their differences is crucial for making informed investment decisions.

What Are Silver Coins?

– Silver coins are minted by government entities and hold a face value.

– They often carry historical or cultural significance, appealing to collectors and investors alike.

– Examples include the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic.

– Silver coins are recognized worldwide and can be easily traded or sold.

What Are Silver Rounds?

– Silver rounds, on the other hand, are produced by private mints and do not hold a face value.

– They are typically .999 fine silver, making them a pure investment vehicle.

– Silver rounds come in various designs and themes, catering to different tastes and preferences.

– Due to their lower premium over spot price, they are favored by investors looking to maximize their silver holdings.

Silver Coins Vs Silver Rounds

– The primary difference lies in their origin: coins are government-minted with a face value, while rounds are privately minted without a face value.

– Silver coins often carry higher premiums due to their collectible and legal tender status, while silver rounds offer a more cost-effective way to invest in silver bullion.

Why Invest in Silver Coins?

– Silver coins offer a blend of intrinsic value and numismatic appeal, making them attractive to collectors.

– They are backed by government guarantees, ensuring their purity and weight.

– Silver proof coins like the American Silver Eagle are highly recognizable and liquid, making them easy to buy, sell, or trade.

Why Invest in Silver Rounds?

– Silver rounds provide a straightforward way to invest in silver bullion without the added premiums associated with coins.

– They offer a wide range of designs and styles, allowing investors to diversify their holdings.

– Silver rounds are an excellent option for those focused solely on the metal content and seeking maximum value for their investment.

Where to Buy Silver Rounds

– Silver rounds can be purchased from reputable silver dealers both online and offline.

– It’s essential to research and compare prices, as well as the reputation of the dealer, before making a purchase.

– Look for dealers offering competitive prices, secure shipping, and excellent customer service.

Top Silver Coins for Investment

– American Silver Eagle: Backed by the U.S. government, it’s one of the most popular silver coins for investors.

– Canadian Silver Maple Leaf: Renowned for its purity and intricate design, it’s highly sought after by collectors.

– Austrian Silver Philharmonic: With its elegant musical theme, it appeals to both investors and music enthusiasts alike.

Best Silver Rounds for Investment

-SilverTowne Prospector: Known for its iconic design, it’s a favorite among silver stackers.

– Sunshine Minting Silver Round: Recognized for its quality and purity, it’s a trusted choice for investors.

– Elemetal Mint Silver Round: Offers various designs and sizes, catering to different investment preferences.

Embracing Long-Term Perspective

– Silver investments often yield the best results when approached with a long-term perspective.

– While short-term price fluctuations are inevitable, silver has historically shown resilience and appreciation over time.

– By focusing on the intrinsic value of silver as a tangible asset, investors can ride out market volatility and capitalize on long-term growth opportunities.

Environmental Considerations

– As an industrial metal, silver plays a vital role in various green technologies such as solar panels and electric vehicles.

– Growing demand for sustainable energy solutions could drive increased industrial usage of silver in the future.

– Investors may consider the environmental impact of their investments and align their portfolios with companies and technologies promoting sustainability.

Global Economic Factors

– Keep abreast of global economic factors that may affect silver prices, such as GDP growth, inflation rates, and monetary policies.

– Silver’s role as a safe-haven asset during times of economic uncertainty can lead to increased demand and upward pressure on prices.

– Geopolitical events, trade tensions, and currency fluctuations also influence silver markets and investor sentiment.

Risk Management Strategies

– Implement risk management strategies to protect your silver investments from potential downside risks.

– Diversification across different asset classes and geographical regions helps mitigate concentration risk.

– Regularly review and rebalance your investment portfolio to maintain alignment with your financial goals and risk tolerance.

Conclusion

In the debate of silver coins vs silver rounds, the choice ultimately depends on individual investment goals and preferences. Whether seeking numismatic value, purity, or cost-effectiveness, both options offer unique advantages. By understanding the difference between silver coin and silver round, investors can make informed decisions to diversify their silver products effectively.

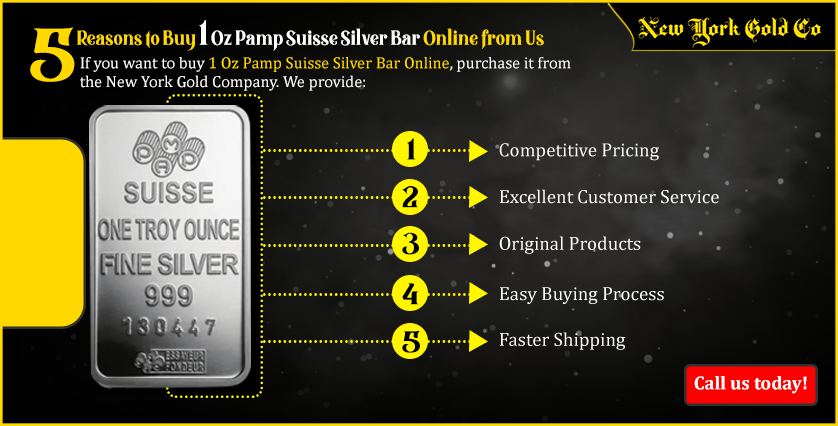

Ready to start investing in silver? Explore a wide range of affordable silver rounds and top silver coins for investment at New York Gold Co. With competitive prices and exceptional service, we make precious metals investment accessible to everyone. Visit our website today and begin your journey towards financial security with silver.